Strong Q3 Revenue Growth Driven by Expanding Commercial Traction

Vancouver, British Columbia, February 11, 2026 — Burcon NutraScience Corporation (“Burcon” or the “Company”) (TSX: BU) (OTCQB: BRCNF), a global technology leader in plant-based protein innovation, reported results for the fiscal third quarter ended December 31, 2025.

“Fiscal Q3 marked an important milestone in Burcon’s commercial growth,” said Kip Underwood, Burcon’s chief executive officer. “We ramped production, fulfilled recurring customer orders, and strengthened key customer relationships, building momentum toward broader market adoption. With strong support from our manufacturing partner and insiders, we remain focused on scaling efficiently and executing our long-term growth strategy.”

Key Operational highlights for the third quarter ended December 31, 2025[1]:

Strong revenue growth: Revenue for the quarter was $739,000 up approximately 1100% from $61,000 in the prior-year period, driven by increased commercial production and repeat customer orders.

Accelerating commercial momentum: Customer demand continued to exceed expectations resulting in the Company making targeted investments to accelerate growth and expand production capacity.

Strengthening balance sheet: Closed a $1.25 million first tranche of a $6.9 million private placement of convertible debentures financing (the “Private Placement”) through a direct investment from the Company’s manufacturing partner owners, underscoring strong alignment and confidence in Burcon’s long-term strategy.

Management Commentary

Fiscal 2026 third quarter was highlighted by strong revenue growth and expanding commercial momentum. Customer demand for Burcon’s high-performance plant-based protein ingredients continue to exceed business plan expectations. The robust demand is translating into recurring commercial orders and prompting targeted investments to accelerate our growth.

Burcon’s robust pipeline of over 200 active customer projects continue to support ongoing commercial progress. New customers are transitioning from final product trials to commercial orders and existing customers are placing larger, repeat purchase orders. This momentum underscores the increasing adoption of Burcon’s high-purity protein ingredients across multiple food and beverage consumer applications.

In response to growing demand, Burcon is leaning into growth by investing in expanded production capacity and enhanced operational capabilities. The final tranche of the Company’s announced $6.9 million Private Placement is expected to close on or around February 24, 2026, and is intended to fund continued commercial expansion and support long-term growth.

With strong commercial traction, Burcon is executing with discipline as we rapidly scale our operations. We continue to prioritize capital efficiency, operational excellence and long-term customer relationships.

Financial Results

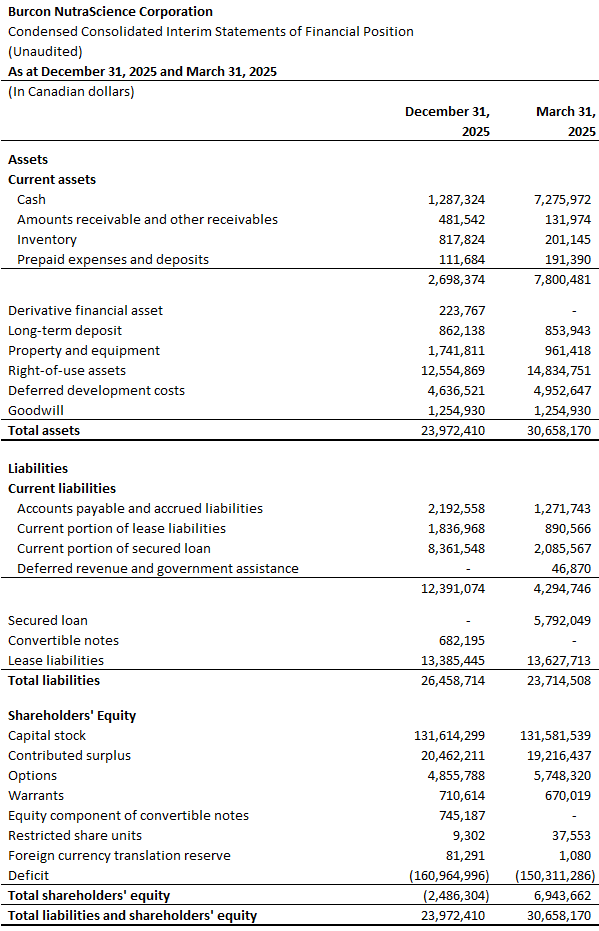

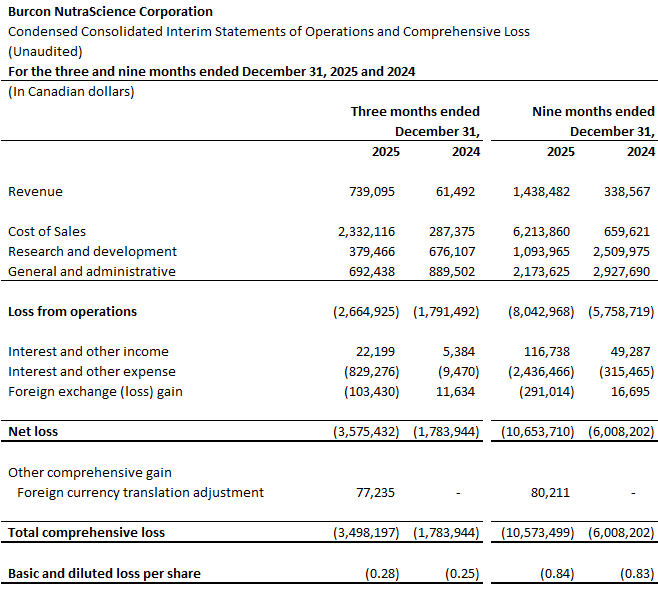

In the three and nine months ended December 31, 2025, Burcon generated revenue of $739,000 and $1,439,000, respectively, which represents an approximately 1100% and 325% increase in revenues from the prior year comparable periods. The increase in revenue is a result of protein sales and the provision of contract manufacturing services at the Galesburg production facility.

In the nine months ended December 31, 2025, the Company launched commercial production of its plant proteins and continued to scale production and sales. The Company reported net cash used in operating activities of $6.2 million as compared to $4.5 million in the same period in the prior year. The Company reported a net loss of $10.7 million or $0.84 per basic and diluted share, as compared to $6.0 million or $0.83 per basic and diluted share in the same period last year. The increases in net cash used in operating activities and net loss were driven by the $5.5 million increase in cost of sales, which encompasses startup and commissioning costs and ongoing production costs of the Galesburg facility. This increase was partially offset by a 56% decrease in research and development expenditures and a 26% decrease in general and administrative expenditures from the comparable period as the Company focused its efforts on commercialization and production at the Galesburg facility.

As at December 31, 2025, Burcon had $1.3 million of cash and had a negative working capital of $9.7 million. The working capital deficiency is primarily driven by the current nature of the senior secured loan, whereby the lender is a related party and Burcon’s largest shareholder. Subsequent to December 31, 2025, the Company obtained a $0.5 million short-term loan and is undergoing a $6.9 million Private Placement whereby the final tranche is expected to close on or about February 24, 2026. For full details on the Company’s financial results, refer to the financial statements for the three and nine months ended December 31, 2025 and management’s discussion and analysis for such period filed on www.sedarplus.ca.

Execution of Loan Agreement

Burcon is also pleased to announce that it has entered into a loan agreement (the “Loan Agreement”) pursuant to which an entity related to a director of Burcon (the “Lender”) will provide Burcon with an unsecured loan (the “Loan”) of $480,000 (the “Loan Amount”) for a term expiring on the earlier of 30 days from the Closing Date (defined below) and the completion of the Private Placement announced by Burcon on January 2, 2026 and January 9, 2026.

The Loan was drawn by Burcon on February 10, 2026 (the “Closing Date”). The Lender was paid a commitment fee of $2,700. The Loan Amount will bear interest at a rate of 12% per annum with interest payable on the last day of each calendar month with a minimum interest amount payable of $4,800. The Loan Amount and all unpaid interest are expected to be repaid from the proceeds of the Private Placement.

The net proceeds from the Loan will be used to accelerate the commercial production and sales of Burcon proteins, for general corporate purposes and as bridge funding until the Private Placement is closed.

The Loan is considered a “related party transaction” pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). Burcon is relying on the exemption available under Section 5.7(1)(a) of MI 61-101 minority shareholder approval requirement. Additionally, the Loan is exempt from the formal valuation requirement of MI 61-101 since it is a related party transaction under section (j) of the “related party transaction” definition of MI 61-101.

Conference Call Details

Burcon will hold an investor conference call and webcast on Wednesday, February 11, 2026 at 5:00pm ET.

A link to the webcast of the conference call is available on Burcon’s website under “Presentations” or directly here. The webcast will also be archived for future playback.

Investors interested in participating in the live call can dial in using the details below:

Date: Wednesday February 11, 2026

Time: 5:00 p.m. Eastern time (2:00 p.m. Pacific time)

Toll-free dial-in (North America): 1-800-717-1738

Dial-in (toll/international): 1-646-307-1865

Conference ID: 50822

About Burcon NutraScience Corporation

Burcon is a global technology leader in high-performance plant-based proteins for the food and beverage industry. Our commercial ingredients offer superior taste, texture, and functionality—ideal for formulators seeking next-generation protein solutions. Backed by over two decades of innovation, Burcon holds an extensive patent portfolio covering novel proteins derived from pea, canola, soy, hemp, sunflower, and other plant sources. As a key player in the rapidly growing plant-based market, Burcon is committed to sustainability and to creating best-in-class protein solutions that are better for people and the planet. Learn more at www.burcon.ca.

Forward-Looking Information Cautionary Statement

The TSX has not reviewed and does not accept responsibility for the adequacy of the content of the information contained herein. This press release contains forward-looking statements or forward-looking information within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation. Forward-looking statements or forward-looking information involve risks, uncertainties and other factors that could cause actual results, performances, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements or forward-looking information can be identified by words such as “anticipate,” “aim”, “intend,” “plan,” “goal,” “project,” “estimate,” “expect,” “believe,” “future,” “likely,” “may,” “should,” “could,” “will” and similar references to future periods. All statements included in this release, other than statements of historical fact, are forward-looking statements. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements or information. Important factors that could cause actual results to differ materially from Burcon’s plans and expectations include the implementation of our business model and growth strategies; trends and competition in our industry our future business development, financial condition and results of operations and our ability to obtain financing cost-effectively; potential changes of government regulations, and other risks and factors detailed herein and from time to time in the filings made by Burcon with securities regulators and stock exchanges, including in the section entitled “Risk Factors” in Burcon’s annual information form for the year ended March 31, 2025 and its other public filings with Canadian securities regulators on SEDAR+ at www.sedarplus.ca. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Any forward-looking statement or information speaks only as of the date on which it was made, and, except as may be required by applicable securities laws, Burcon disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. Although Burcon believes the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance, and, accordingly, investors should not rely on such statements.

Industry and Investor Contact

Paul Lam

Director, Investor Relations and Communications

Burcon NutraScience Corporation

490 – 999 West Broadway, Vancouver, BC, V5Z 1K5

Tel (604) 733-0896, Toll-free (888) 408-7960

Media Contact:

Steve Campbell, APR

President

Campbell & Company Public Relations

Tel (604) 888-5267

[1] All amounts herein are presented in Canadian dollars ($)